Mr moys wife has a medicare advantage plan – Mr. Moy’s wife has a Medicare Advantage plan, and understanding its benefits, eligibility, costs, coverage, and enrollment process is crucial. This guide delves into the intricacies of Medicare Advantage plans, empowering you to make informed decisions for your healthcare.

Medicare Advantage plans offer a wide range of options, and choosing the right one can be daunting. This guide provides a step-by-step approach to help you navigate the complexities of Medicare Advantage plans and find the best coverage for Mr.

Moy’s wife.

Medicare Advantage Plans: Mr Moys Wife Has A Medicare Advantage Plan

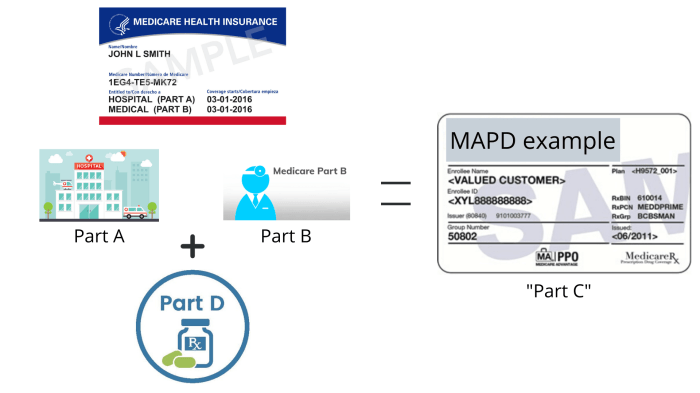

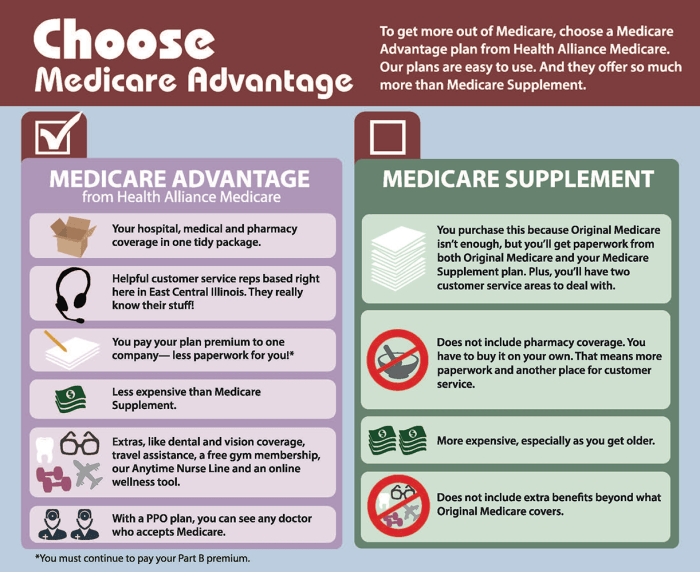

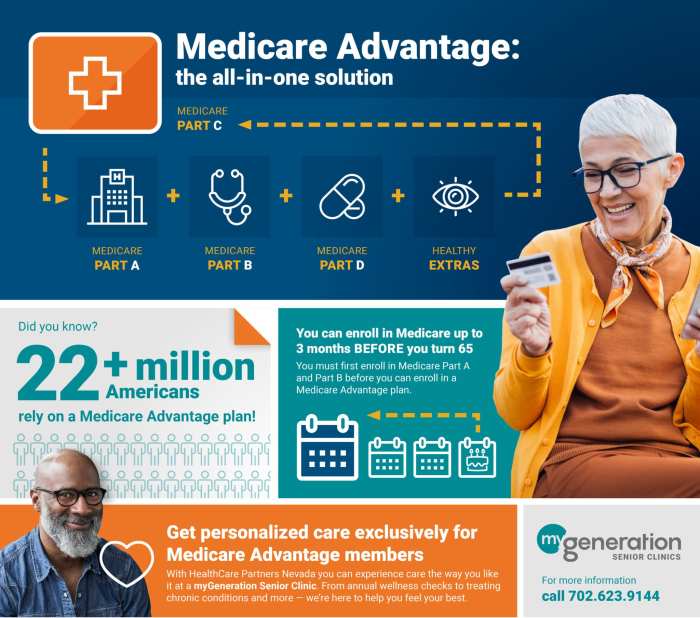

Medicare Advantage plans are an alternative to Original Medicare that provides comprehensive health coverage. These plans are offered by private insurance companies and must follow rules set by Medicare. Medicare Advantage plans typically include coverage for doctor visits, hospital stays, prescription drugs, and other health care services.

Types of Medicare Advantage Plans

There are several different types of Medicare Advantage plans available, including:

- Health Maintenance Organizations (HMOs): HMOs require you to choose a primary care physician (PCP) who will coordinate your care. You must get referrals from your PCP to see specialists.

- Preferred Provider Organizations (PPOs): PPOs allow you to see any doctor or specialist you want, but you will pay less if you use providers within the plan’s network.

- Private Fee-for-Service (PFFS) plans: PFFS plans allow you to see any doctor or specialist you want, and you will be reimbursed for the services you receive.

- Special Needs Plans (SNPs): SNPs are designed for people with specific health conditions, such as chronic illnesses or disabilities.

Eligibility for Medicare Advantage Plans

To be eligible for a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B. You must also live in the plan’s service area.

Costs and Coverage of Medicare Advantage Plans

The costs of Medicare Advantage plans vary depending on the type of plan you choose and the insurance company you select. Some plans have low monthly premiums but high deductibles, while others have higher monthly premiums but lower deductibles.Medicare Advantage plans typically cover a wide range of health care services, including:

- Doctor visits

- Hospital stays

- Prescription drugs

- Mental health services

- Vision care

- Dental care

Choosing the Right Medicare Advantage Plan, Mr moys wife has a medicare advantage plan

When choosing a Medicare Advantage plan, it is important to consider your health care needs and budget. You should also compare the different plans available in your area.Here are some factors to consider when choosing a Medicare Advantage plan:

- Monthly premiums

- Deductibles

- Copays

- Network of providers

- Coverage for specific health care services

Q&A

What are the benefits of Medicare Advantage plans?

Medicare Advantage plans offer several benefits, including expanded coverage for services not covered by Original Medicare, such as dental, vision, and hearing care. They also often have lower out-of-pocket costs, such as premiums, deductibles, and copays.

How do I determine if Mr. Moy’s wife is eligible for a Medicare Advantage plan?

To be eligible for a Medicare Advantage plan, Mr. Moy’s wife must be enrolled in Medicare Part A and Part B and reside in the plan’s service area.

What is the enrollment process for Medicare Advantage plans?

The enrollment process for Medicare Advantage plans typically involves contacting the plan provider directly or through the Medicare website. The enrollment period runs from October 15th to December 7th each year.