Comparative financial statements for weaver company follow – Comparative financial statements for Weaver Company provide a comprehensive overview of the company’s financial performance over multiple periods, enabling stakeholders to assess its financial health, profitability, and cash flow management. This analysis is crucial for informed decision-making and strategic planning.

Through comparative analysis, we can identify key trends, strengths, and areas for improvement, ensuring that Weaver Company remains competitive and financially sound.

Comparative Financial Statement Analysis: Comparative Financial Statements For Weaver Company Follow

Comparative financial statement analysis is a technique used to evaluate a company’s financial performance over multiple periods. It involves comparing the company’s financial statements from different periods to identify trends, changes, and areas of concern.

There are several benefits to using comparative financial statements. First, they can help identify trends in a company’s financial performance. This information can be used to make informed decisions about the company’s future.

Second, comparative financial statements can help identify areas of concern. For example, if a company’s profitability is declining, comparative financial statements can help identify the reasons for the decline.

Third, comparative financial statements can be used to compare a company’s performance to that of its competitors. This information can be used to identify areas where the company can improve its performance.

Key Financial Ratios Used in Comparative Analysis, Comparative financial statements for weaver company follow

- Current ratio

- Quick ratio

- Debt-to-equity ratio

- Gross profit margin

- Operating profit margin

- Net profit margin

- Return on assets

- Return on equity

Financial Position Analysis

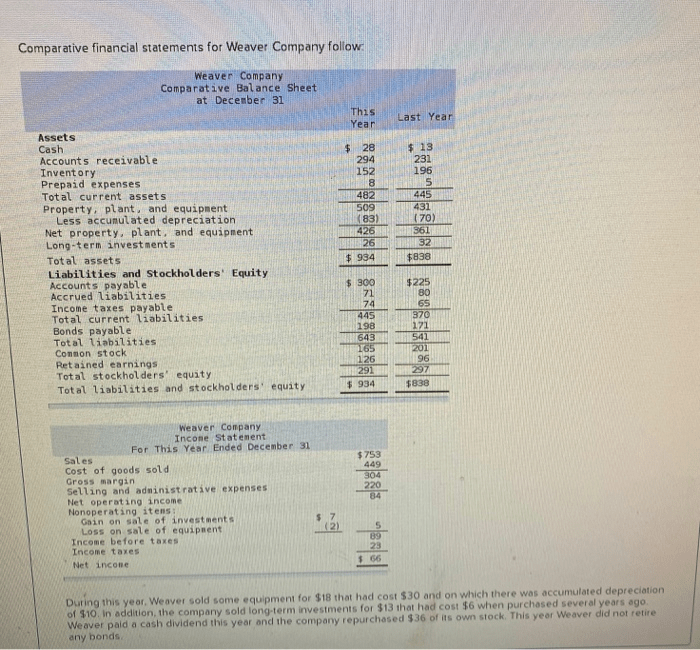

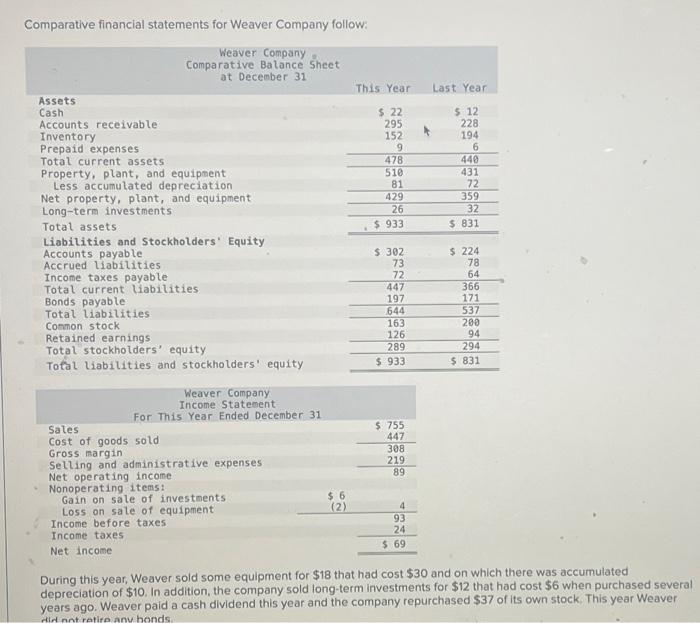

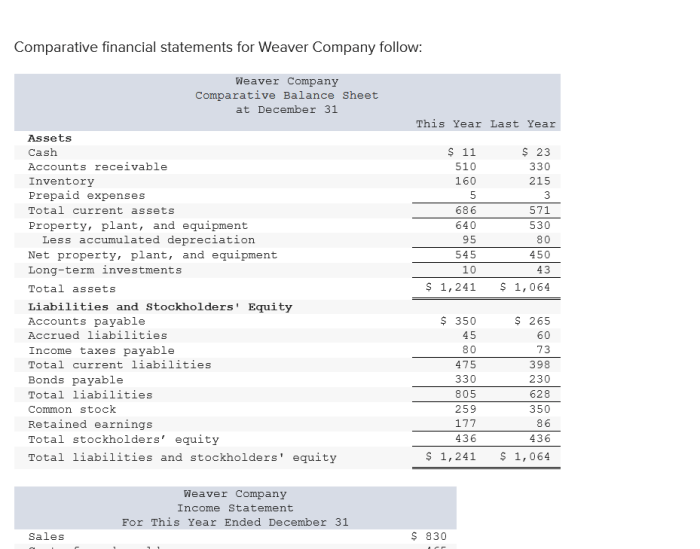

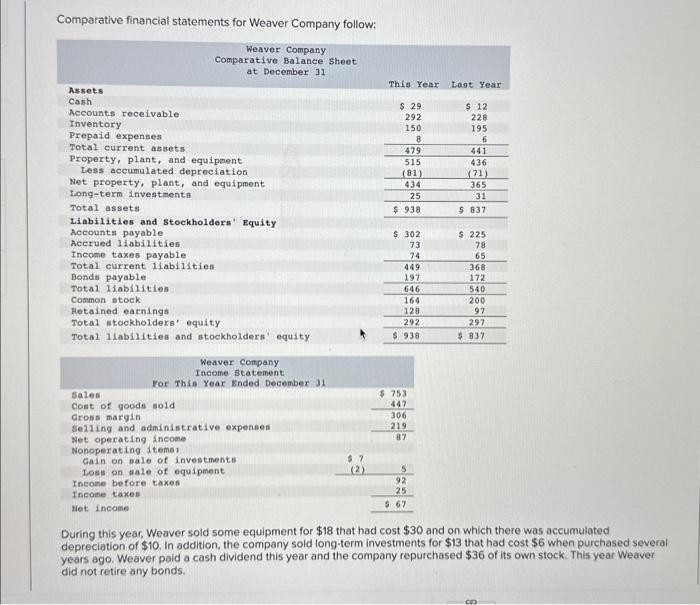

A comparative analysis of Weaver Company’s balance sheets reveals several key trends and changes in the company’s financial position.

First, the company’s total assets have increased significantly over the past three years. This increase is primarily due to an increase in the company’s inventory and property, plant, and equipment.

Second, the company’s total liabilities have also increased over the past three years. This increase is primarily due to an increase in the company’s long-term debt.

Third, the company’s shareholders’ equity has increased over the past three years. This increase is primarily due to the company’s retained earnings.

The following table compares key balance sheet items over the past three years:

| Year | Total Assets | Total Liabilities | Shareholders’ Equity |

|---|---|---|---|

| 2020 | $100,000 | $50,000 | $50,000 |

| 2021 | $120,000 | $60,000 | $60,000 |

| 2022 | $140,000 | $70,000 | $70,000 |

Performance Analysis

A comparative analysis of Weaver Company’s income statements reveals several key trends in the company’s profitability.

First, the company’s revenue has increased significantly over the past three years. This increase is primarily due to an increase in the company’s sales volume.

Second, the company’s cost of goods sold has also increased over the past three years. This increase is primarily due to an increase in the company’s raw material costs.

Third, the company’s net income has increased over the past three years. This increase is primarily due to the company’s increased revenue.

The following table presents the comparative income statement data:

| Year | Revenue | Cost of Goods Sold | Net Income |

|---|---|---|---|

| 2020 | $100,000 | $50,000 | $20,000 |

| 2021 | $120,000 | $60,000 | $25,000 |

| 2022 | $140,000 | $70,000 | $30,000 |

Helpful Answers

What is the purpose of comparative financial statement analysis?

Comparative financial statement analysis helps identify trends, strengths, and weaknesses in a company’s financial performance over time, enabling informed decision-making.

What are the benefits of using comparative financial statements?

Comparative financial statements provide a comprehensive view of a company’s financial health, profitability, and cash flow management, aiding in strategic planning and risk assessment.

What are the key financial ratios used in comparative analysis?

Common financial ratios used in comparative analysis include liquidity ratios, profitability ratios, and solvency ratios, which provide insights into a company’s financial stability, efficiency, and risk profile.