You have a credit card with a balance of 2856 – You have a credit card with a balance of $2856. This is a significant amount of debt, and it can be overwhelming to think about how to pay it off. But don’t worry, you’re not alone. Millions of Americans are struggling with credit card debt, and there are many resources available to help you get out of debt.

This guide will provide you with everything you need to know about managing credit card debt. We’ll cover the basics of credit card debt, how to create a repayment plan, and explore debt relief options. We’ll also provide tips for managing future credit card usage so that you can avoid getting into debt again.

Understanding Credit Card Debt: You Have A Credit Card With A Balance Of 2856

Credit card debt arises when an individual carries an unpaid balance on their credit card. It incurs interest charges and can have significant financial implications.

There are two main types of credit card debt:

- Revolving debt:This type of debt allows the cardholder to carry a balance from month to month, with interest charged on the outstanding balance.

- Installment debt:This type of debt involves borrowing a fixed amount that is repaid in regular installments over a set period.

Factors contributing to credit card debt include overspending, high interest rates, and financial emergencies.

Analyzing the Current Situation

To assess the severity of credit card debt, it is crucial to calculate the total amount owed, including the balance, outstanding interest, and any fees.

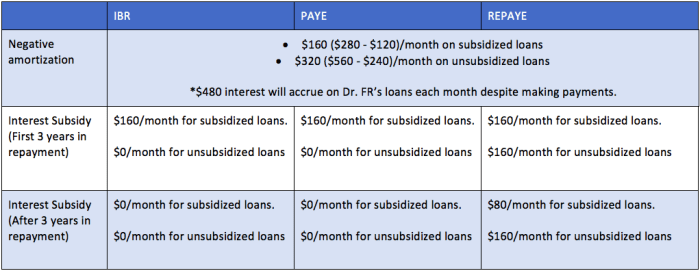

The interest rate on the credit card determines the total cost of the debt. A higher interest rate leads to higher interest charges, making it more challenging to repay the debt.

Minimum payments are typically required on credit cards. However, making only minimum payments can prolong the debt repayment process and increase the total interest paid.

Developing a Repayment Plan

Creating a detailed repayment plan is essential for managing credit card debt effectively. This plan should Artikel the steps to repay the debt in a timely manner.

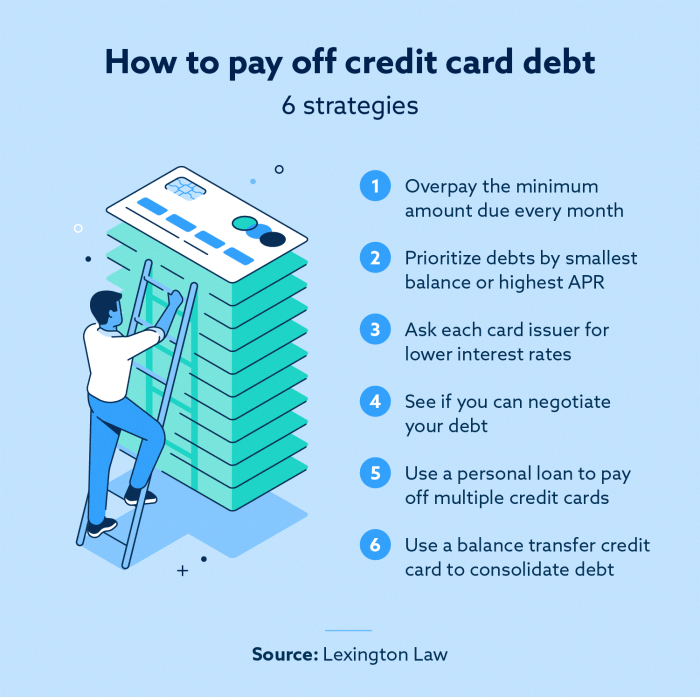

There are two common repayment methods:

- Debt avalanche:This method involves paying off the debt with the highest interest rate first, while making minimum payments on other debts.

- Debt snowball:This method involves paying off the smallest debt first, regardless of the interest rate, and then using the freed-up funds to pay off the next smallest debt.

Establishing a timeline for repayment and adhering to it is crucial for successful debt repayment.

Exploring Debt Relief Options

In certain situations, debt relief options may be considered to address excessive credit card debt.

- Debt consolidation:This involves combining multiple debts into a single loan with a lower interest rate.

- Debt settlement:This involves negotiating with creditors to pay less than the total amount owed.

- Bankruptcy:This is a legal process that discharges or reorganizes debts, but it can have severe consequences.

It is essential to seek professional advice before considering debt relief options to determine the most appropriate solution.

Managing Future Credit Card Usage

Responsible credit card usage is crucial to avoid future debt. Budgeting, tracking expenses, and setting spending limits are essential practices.

Alternative payment methods, such as cash or debit cards, can help reduce the risk of overspending and accumulating debt.

User Queries

What is credit card debt?

Credit card debt is a type of unsecured debt that you owe to a credit card company. Unsecured debt means that the debt is not backed by any collateral, such as a car or a house.

What are the different types of credit card debt?

There are two main types of credit card debt: revolving debt and installment debt. Revolving debt is the type of debt that you can carry from month to month, and it is typically used for everyday purchases. Installment debt is the type of debt that you pay off in fixed monthly payments, and it is typically used for larger purchases, such as a car or a vacation.

What are the factors that contribute to credit card debt?

There are many factors that can contribute to credit card debt, including overspending, high interest rates, and financial emergencies.

How can I get out of credit card debt?

There are many ways to get out of credit card debt, including creating a repayment plan, exploring debt relief options, and managing future credit card usage.