An insured has a stop-loss limit of 000 – In the realm of insurance, an insured’s stop-loss limit of $5,000 emerges as a pivotal concept that profoundly shapes the extent of coverage and potential financial implications. This threshold, meticulously crafted to safeguard against catastrophic expenses, warrants a thorough examination to unravel its intricacies and implications.

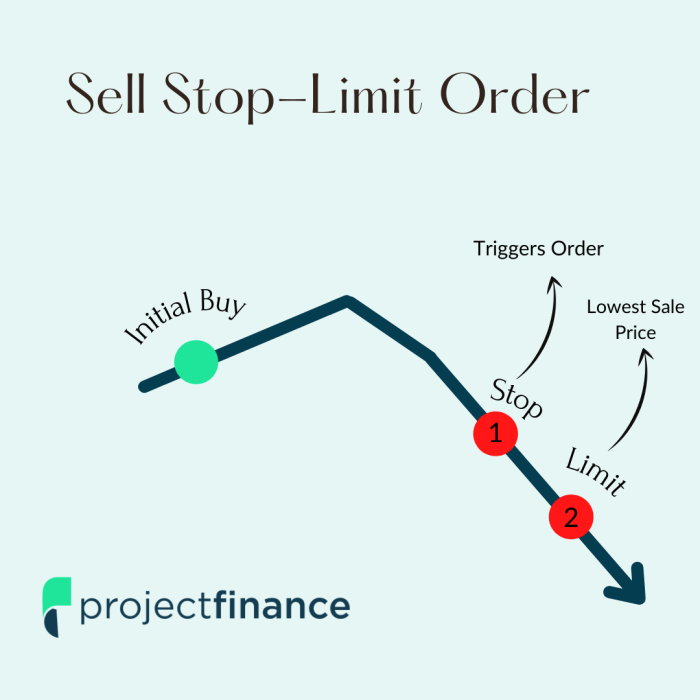

A stop-loss limit, in essence, establishes a monetary boundary beyond which the insured assumes financial responsibility for any additional covered expenses. In the context of the $5,000 limit, the insured bears the burden of costs exceeding this threshold, while the insurance provider covers expenses up to that amount.

Stop-Loss Limit: An Insured Has A Stop-loss Limit Of 000

In the context of insurance, a stop-loss limit is a maximum amount that an insured will be responsible for paying out-of-pocket for covered expenses. The purpose of a stop-loss limit is to provide financial protection to the insured against catastrophic medical expenses.

Definitions

Stop-Loss Limit:A contractual provision that limits the maximum amount of financial liability for an insured.

Insured:An individual or entity covered by an insurance policy.

Application

A stop-loss limit works by establishing a threshold beyond which the insurance company will cover all remaining eligible expenses. For instance, if an insured has a stop-loss limit of $5,000, they would be responsible for paying any covered expenses up to that amount.

Once the expenses exceed $5,000, the insurance company would cover the remaining balance.

Impact on Coverage, An insured has a stop-loss limit of 000

A stop-loss limit can significantly impact an insured’s coverage by providing a safety net against unexpected high medical costs. It can protect the insured from financial ruin and ensure they can continue to access necessary medical care.

Benefits of a Stop-Loss Limit:

- Financial protection against catastrophic medical expenses

- Peace of mind knowing there is a limit to out-of-pocket costs

- Preservation of assets and savings

Limitations

While stop-loss limits offer financial protection, they also have some limitations:

- Premium Costs:Policies with stop-loss limits typically have higher premiums compared to policies without such limits.

- Limit Amount:The limit amount may not be sufficient to cover all potential medical expenses.

- Coverage Exclusions:Some expenses may not be covered under the stop-loss limit, such as non-eligible medical services or expenses incurred outside the policy’s coverage period.

Impact of $5,000 Limit:A stop-loss limit of $5,000 means that the insured would be responsible for paying any covered expenses up to $5,000. This limit provides a significant level of protection, but it may not be adequate for individuals with complex or chronic medical conditions that require extensive treatment.

Considerations

When choosing a stop-loss limit, several factors should be considered:

- Financial Situation:The insured’s financial resources and ability to pay out-of-pocket expenses

- Health Status:The insured’s current and potential future health risks

- Premium Costs:The additional cost of a policy with a stop-loss limit

- Coverage Needs:The insured’s specific medical coverage requirements

Situations Where a Stop-Loss Limit May Be Appropriate:

- Individuals with high-deductible health plans (HDHPs)

- Individuals with chronic or complex medical conditions

- Individuals who are self-employed or uninsured

Query Resolution

What is the primary purpose of a stop-loss limit?

A stop-loss limit serves as a financial safeguard, protecting the insured from catastrophic expenses by limiting their out-of-pocket costs to a predetermined amount.

How does a stop-loss limit of $5,000 impact coverage?

With a $5,000 stop-loss limit, the insured is responsible for any covered expenses that exceed $5,000, while the insurance provider covers costs up to that limit.

Are there any drawbacks to having a stop-loss limit?

While stop-loss limits provide financial protection, they may also result in higher premiums and reduced coverage for expenses beyond the established threshold.