Choose the best scenario for refinancing – Choosing the best refinancing scenario is a critical decision that can significantly impact your financial future. This guide provides a comprehensive overview of the different refinancing options available, the factors to consider when making a decision, and the potential benefits and drawbacks of each scenario.

By understanding the nuances of refinancing, you can make an informed decision that aligns with your financial goals and objectives.

Understanding Refinancing Scenarios

Refinancing a loan involves obtaining a new loan to pay off an existing one. It can be a strategic move for borrowers to secure better terms, lower interest rates, or consolidate multiple debts.

There are several types of refinancing scenarios, each tailored to specific financial goals and situations:

- Rate-and-term refinance:Swapping an existing loan for a new one with a lower interest rate or a more favorable loan term.

- Cash-out refinance:Borrowing more than the existing loan balance, taking out the difference as cash, often used for home improvements or debt consolidation.

- Debt consolidation refinance:Combining multiple high-interest debts into a single loan with a lower interest rate, simplifying debt management.

Factors to Consider When Choosing a Scenario

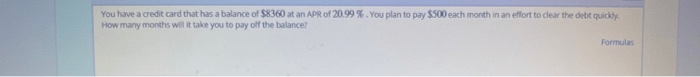

When selecting a refinancing scenario, it’s crucial to consider several key factors:

- Interest rates:The interest rate on the new loan is a major determinant of the monthly payments and overall cost of borrowing. Lower interest rates can significantly reduce the cost of refinancing.

- Loan terms:The length of the new loan (e.g., 15 years, 30 years) affects the monthly payments and total interest paid. Longer terms result in lower monthly payments but higher overall interest costs.

- Fees:Refinancing typically involves various fees, such as origination fees, closing costs, and appraisal fees. These fees should be factored into the overall cost of refinancing.

Assessing the Benefits and Drawbacks of Each Scenario: Choose The Best Scenario For Refinancing

| Scenario | Benefits | Drawbacks |

|---|---|---|

| Rate-and-term refinance |

|

|

| Cash-out refinance |

|

|

| Debt consolidation refinance |

|

|

Making an Informed Decision

To make an informed refinancing decision, it’s advisable to:

- Consult with a financial advisor or lender:Seek professional advice to assess your financial situation and determine the best refinancing scenario.

- Compare refinancing offers:Obtain quotes from multiple lenders and compare interest rates, fees, and loan terms to find the most competitive option.

- Consider your long-term financial goals:Evaluate whether refinancing aligns with your financial objectives, such as saving money, reducing debt, or increasing equity.

Additional Considerations

- Impact on credit scores:Refinancing may temporarily lower credit scores due to hard inquiries and changes in credit utilization.

- Tax implications:Cash-out refinances may have tax implications, so it’s essential to consult with a tax advisor.

- Resources for further research:For more information on refinancing, refer to the following resources:

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/ask-cfpb/what-is-refinancing-and-how-does-it-work-en-1684/

- Federal Trade Commission (FTC): https://www.ftc.gov/business-guidance/resources/refinancing-mortgage-what-you-need-know

Expert Answers

What is the main purpose of refinancing?

Refinancing involves obtaining a new loan to pay off an existing loan, typically with the goal of securing a lower interest rate, reducing monthly payments, or consolidating multiple debts.

What are the different types of refinancing scenarios?

Common refinancing scenarios include rate-and-term refinancing, cash-out refinancing, and debt consolidation refinancing. Each scenario offers unique benefits and drawbacks, depending on your financial situation.

How do I know if refinancing is right for me?

Refinancing can be beneficial if you have a good credit score, a stable income, and a long-term financial goal. Consider refinancing if you want to lower your interest rate, reduce your monthly payments, or access additional cash.