Compare auto loans worksheet answers are essential for anyone looking to finance a vehicle. This comprehensive guide provides an in-depth overview of auto loan features, calculations, and refinancing options, empowering you to make informed decisions and secure the best possible loan for your needs.

Whether you’re a first-time car buyer or an experienced borrower, this guide will equip you with the knowledge and tools to navigate the complexities of auto financing and find the most advantageous loan terms.

Loan Comparison Table

The loan comparison table is a useful tool for comparing different auto loan offers and making an informed decision about which loan is right for you. The table should include the following information:

- Lender Name

- Interest Rate

- Loan Term

- Monthly Payment

- Total Interest Paid

Once you have gathered this information, you can compare the different loan offers side-by-side to see which one offers the best terms. Here is an example of a loan comparison table:

| Lender Name | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| Lender A | 3.99% | 60 months | $500 | $1,196 |

| Lender B | 4.49% | 72 months | $450 | $1,638 |

| Lender C | 4.99% | 84 months | $400 | $2,156 |

As you can see, Lender A offers the lowest interest rate, but the shortest loan term. This means that you will have to make higher monthly payments, but you will pay less interest over the life of the loan. Lender B offers a slightly higher interest rate, but a longer loan term.

This means that you will have to make lower monthly payments, but you will pay more interest over the life of the loan. Lender C offers the highest interest rate, but the longest loan term. This means that you will have to make the lowest monthly payments, but you will pay the most interest over the life of the loan.

The best way to decide which loan is right for you is to compare the monthly payments and the total interest paid. The loan with the lowest monthly payment may not be the best deal if you end up paying more interest over the life of the loan.

Similarly, the loan with the lowest interest rate may not be the best deal if you end up having to make higher monthly payments.

Loan Features

Auto loans offer various features that can impact the borrowing experience. Understanding these features is crucial for making informed decisions when selecting a loan.

Key features of auto loans include pre-approval, loan-to-value ratio, and repayment options. Each feature comes with its own advantages and disadvantages, which borrowers should carefully consider before making a choice.

Pre-Approval

Pre-approval is a conditional approval for a loan amount based on a preliminary review of the borrower’s financial situation. It provides an estimate of the loan amount and interest rate the borrower may qualify for, without a formal credit check or appraisal.

Pros:

- Provides a clear understanding of loan eligibility.

- Streamlines the loan application process.

- Enhances negotiating power with dealerships.

Cons:

- Not a guaranteed loan approval.

- May require a hard credit check upon formal application.

Loan-to-Value Ratio (LTV)

The loan-to-value ratio (LTV) represents the percentage of the vehicle’s value that the loan covers. It is calculated by dividing the loan amount by the vehicle’s appraised value.

Pros:

- Lower LTVs typically result in lower interest rates.

- Can reduce the risk of being “upside down” on the loan.

Cons:

- Higher LTVs may require a larger down payment or higher interest rates.

- Can limit the borrower’s options for refinancing or selling the vehicle.

Repayment Options, Compare auto loans worksheet answers

Auto loans offer various repayment options, each with its own implications.

Fixed-Rate Loans:

- Interest rate remains constant throughout the loan term.

- Provides stability in monthly payments.

Adjustable-Rate Loans:

- Interest rate fluctuates based on market conditions.

- Can lead to lower initial payments but carries the risk of higher payments in the future.

Balloon Payments:

- Final payment is significantly larger than the regular payments.

- Can reduce monthly payments but requires a larger lump sum payment at the end of the loan term.

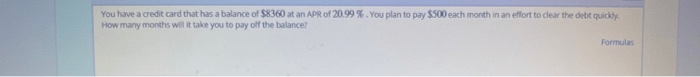

Loan Calculations: Compare Auto Loans Worksheet Answers

Calculating loan payments and interest charges is crucial for informed financial decisions. Understanding the formulas and applying them accurately ensures accurate estimations of the financial obligations associated with a loan.

Two key calculations in loan assessment are monthly payments and total interest paid. These values provide insights into the affordability and overall cost of a loan.

Monthly Payment

The monthly payment is the fixed amount paid by the borrower to the lender over the loan term. It comprises both principal (the borrowed amount) and interest (the cost of borrowing). The formula for calculating monthly payments is:

Monthly Payment = P

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

where:

- P is the principal amount borrowed

- r is the monthly interest rate (annual interest rate divided by 12)

- n is the total number of months of the loan term

Total Interest Paid

Total interest paid represents the total cost of borrowing over the loan term. It is calculated by subtracting the principal amount from the total amount paid back to the lender.

Total Interest Paid = Total Amount Paid

Principal

or using the monthly payment formula:

Total Interest Paid = n

- Monthly Payment

- P

where:

- n is the total number of months of the loan term

- Monthly Payment is calculated using the formula above

- P is the principal amount borrowed

Examples

Consider a loan of $10,000 with an annual interest rate of 5% for a term of 3 years (36 months).

Monthly Payment:

“`Monthly Payment = 10000

- (0.05/12

- (1 + 0.05/12)^36) / ((1 + 0.05/12)^36

- 1)

Monthly Payment = $303.97“`

Total Interest Paid:

“`Total Interest Paid = 36

- $303.97

- 10000

Total Interest Paid = $1,143.52“`

Loan Refinancing

Refinancing an auto loan involves replacing the existing loan with a new one, typically with more favorable terms, such as a lower interest rate or extended loan term. This can result in significant savings over the life of the loan.

However, refinancing also comes with potential drawbacks, including:

- Loan Origination Fees:Refinancing may incur fees associated with processing and closing the new loan.

- Credit Impact:Applying for a new loan can result in a hard credit inquiry, which can temporarily lower your credit score.

- Extended Loan Term:While refinancing may lower your monthly payments, it could extend the loan term, potentially increasing the total interest paid.

Step-by-Step Guide to Refinancing a Loan

- Check Your Credit Score:Obtain your credit score to determine your eligibility for favorable refinancing rates.

- Shop for Lenders:Compare interest rates, fees, and terms from multiple lenders to find the best offer.

- Gather Required Documents:Prepare documentation such as proof of income, employment, and vehicle ownership.

- Apply for Refinancing:Submit your application to the chosen lender and provide the necessary documents.

- Review and Accept Loan Terms:Carefully review the loan agreement and ensure you understand the terms and conditions.

- Close the Loan:Once the loan is approved, sign the closing documents and make arrangements for the payoff of your existing loan.

Additional Resources

Additional resources are available to help you make an informed decision about auto loans.

Loan calculators can help you estimate your monthly payments and total interest charges. Lenders’ websites provide information about their loan products and rates. Consumer protection agencies offer resources to help you understand your rights and responsibilities as a borrower.

Loan Calculators

- Bankrate: https://www.bankrate.com/calculators/auto-loans/auto-loan-calculator.aspx

- NerdWallet: https://www.nerdwallet.com/auto-loans/auto-loan-calculator

- LendingTree: https://www.lendingtree.com/auto/calculators/auto-loan-calculator

Lenders’ Websites

- Wells Fargo: https://www.wellsfargo.com/auto/auto-loans/

- Capital One: https://www.capitalone.com/auto-loans/

li>USAA: https://www.usaa.com/inet/wc/auto-loans

Consumer Protection Agencies

- Consumer Financial Protection Bureau: https://www.consumerfinance.gov/

- Federal Trade Commission: https://www.ftc.gov/

- National Consumer Law Center: https://www.nclc.org/

Key Questions Answered

What is the most important factor to consider when comparing auto loans?

The interest rate is the most significant factor to consider, as it directly affects the total cost of the loan.

What is the loan-to-value ratio?

The loan-to-value ratio (LTV) is the percentage of the vehicle’s value that is financed. A higher LTV can lead to higher interest rates and stricter loan terms.

Can I refinance an auto loan if I have bad credit?

Refinancing an auto loan with bad credit may be possible, but it may result in higher interest rates and fees. It’s important to explore all options and consider consulting with a financial advisor.